cn14.site

Learn

Best In Home Blood Pressure Machine

Find the Best Blood Pressure Monitor · Up & Up (Target) Automatic Wrist BPM · Up & Up (Target) Automatic Upper Arm · CVS Health Series (Item #. blood pressure, should monitor their blood pressure at home. Home blood In terms of which type of blood pressure monitor is best for you, we. OMRON 5 Series Wireless Upper Arm Blood Pressure Monitor · LifeSource UAPAC One Step Plus Memory Monitor · Homedics Automated Wrist Blood Pressure Machine. SMBP requires the use of a home blood pressure measurement device by the patient to measure blood pressure at different points in time. SMBP plus clinical. Healthmote's Remote Blood Pressure Monitoring Cuff is an effective way of taking care of patients with hypertension and many other ailments. Home Blood Pressure Monitor Personnelle, UA cm ( inches) Be Better Automatic Wrist Blood Pressure Monitor Rexall, RX 22 – 42 cm. Shop for Blood Pressure Monitors in Home Health Care. Buy products such as ( pack) Omron 3 Series Upper Arm Blood Pressure Monitor (Model BP) at. Learn how to use your home monitor and download our home blood pressure monitoring resources. It's good to have a routine – like measuring your blood pressure. Here are our recommendations for the Best Blood Pressure Monitors you can buy in ▻ 5. Oklar Cuff Digital BP Machine. Find the Best Blood Pressure Monitor · Up & Up (Target) Automatic Wrist BPM · Up & Up (Target) Automatic Upper Arm · CVS Health Series (Item #. blood pressure, should monitor their blood pressure at home. Home blood In terms of which type of blood pressure monitor is best for you, we. OMRON 5 Series Wireless Upper Arm Blood Pressure Monitor · LifeSource UAPAC One Step Plus Memory Monitor · Homedics Automated Wrist Blood Pressure Machine. SMBP requires the use of a home blood pressure measurement device by the patient to measure blood pressure at different points in time. SMBP plus clinical. Healthmote's Remote Blood Pressure Monitoring Cuff is an effective way of taking care of patients with hypertension and many other ailments. Home Blood Pressure Monitor Personnelle, UA cm ( inches) Be Better Automatic Wrist Blood Pressure Monitor Rexall, RX 22 – 42 cm. Shop for Blood Pressure Monitors in Home Health Care. Buy products such as ( pack) Omron 3 Series Upper Arm Blood Pressure Monitor (Model BP) at. Learn how to use your home monitor and download our home blood pressure monitoring resources. It's good to have a routine – like measuring your blood pressure. Here are our recommendations for the Best Blood Pressure Monitors you can buy in ▻ 5. Oklar Cuff Digital BP Machine.

Blood Pressure Monitors at Walgreens. If you've been diagnosed with high blood pressure or hypertension, it's important that you keep tabs on your blood. With the same high-accuracy readings as our non-connected monitor, we added the feature to sync your results with our in-house Balance Health app, displaying. Tips for buying a blood pressure monitor · The American Heart Association (AHA) recommends an automatic monitor that uses a cuff that goes on your upper arm . Your Consultant may ask that you check your blood pressure at home and will provide a blood pressure machine for you to do this. It is best to not talk whilst. Select a portable wrist blood pressure monitor to take it with you on the go, or order one of our tabletop digital blood pressure monitors to keep at home. give a better reflection of blood pressure, as being tested in somewhere monitor can discuss with their GP how to monitor their blood pressure at home. You may be more familiar with having your BP checked in a healthcare provider's office during an appointment. In this case, your provider uses a device called a. Some popular and highly rated blood pressure machines for home use in India include Omron HEM It is recommended to consider factors like. The Welch Allyn ABPM is an easy-to-use hour ambulatory blood pressure monitor that is designed to help avoid the effects of white coat hypertension. Home / BP Monitors. Validated blood pressure monitors. Home Download · Office Preferred devices are upper-arm cuff devices with at least one STRIDE BP. The iHealth Track Blood Pressure Monitor offers a hassle-free user experience with its easy-to-use one-button operation. HoMedics Bluetooth Wrist Blood Pressure Monitor · Large, Easy to Read LCD Display ; HoMedics Bluetooth Upper Arm Blood Pressure Monitor · Irregular Heartbeat. I'm looking to invest in an at-home blood pressure monitor, but I'm completely new to this and feeling a bit overwhelmed by all the options out there. Hello Heart is an app to help track blood pressure.[/caption]Finding your BP monitor from the many that are out there is not quite like finding “the one” but. Best Blood Pressure Monitors (BPM) for Wrist Home Usage. Wireless Automatic BP Machine for Adults. Clinically Accurate & Fast Reading Monitoring Kit. Blood pressure monitors can help you promote healthy habits and hearth health. Learn why we think Omron Platinum is the best choice. Best smart blood pressure monitor: Withings BPM Connect; Best budget blood pressure monitor: iHealth Track Connected Blood Pressure Monitor; Best blood. Withings BPM Connect makes it remarkable convenient to take your blood pressure at home. It provides medically accurate blood pressure and heart rate. Home blood pressure monitors cost somewhere between $29 and $ While there are plenty of more expensive monitors available, there's no real reason to pay. Don't buy one that works on the wrist, and definitely avoid finger blood pressure monitors, since they are especially unreliable. A good device costs between.

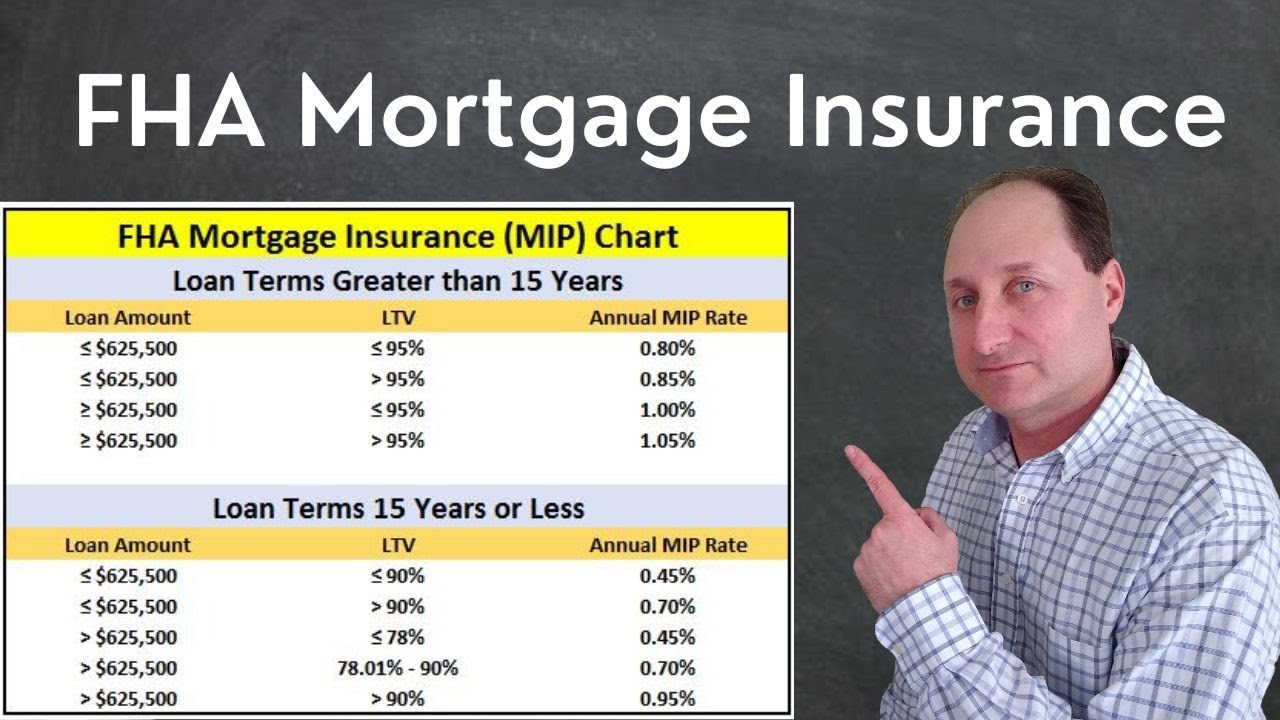

How To Stop Paying Fha Mortgage Insurance

How to Stop Paying FHA Loan Mortgage Insurance For recent FHA loans, you will need to pay insurance premiums for at least 11 years, and you may need to pay. In many cases, the lender will allow the cancellation of mortgage insurance when the loan is paid down to 80% of the original property value. However, lenders. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. How do I stop needing to pay mortgage insurance? · Your principal balance reaches 78% of the home's original value · You reach the halfway point of the mortgage's. How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. The result — You get rid of your old PMI and avoid paying any new PMI premium. Luckily, FHA mortgage insurance is getting more affordable because. Refinance into a conventional loan. Refinancing into any type of conventional loan will remove FHA MIP. However, based on the property's loan –to-value ratio. The insurance must to be in force for at least 5 years. On loans closed June 3, and thereafter, there is no way to stop paying FHA insurance premiums. The value of your home equity does not affect your FHA MIP, and having 20% in home equity will not allow you to cancel it. As a result, homeowners with FHA. How to Stop Paying FHA Loan Mortgage Insurance For recent FHA loans, you will need to pay insurance premiums for at least 11 years, and you may need to pay. In many cases, the lender will allow the cancellation of mortgage insurance when the loan is paid down to 80% of the original property value. However, lenders. Ask to cancel your PMI: If your loan has met certain conditions and your loan to original value (LTOV) ratio falls below 80%, you may submit a written request. How do I stop needing to pay mortgage insurance? · Your principal balance reaches 78% of the home's original value · You reach the halfway point of the mortgage's. How to Avoid Paying PMI · Make a down payment of 20% or more. · Apply for a VA loan (if eligible). A VA loan however only avoids the monthly mortgage insurance. The result — You get rid of your old PMI and avoid paying any new PMI premium. Luckily, FHA mortgage insurance is getting more affordable because. Refinance into a conventional loan. Refinancing into any type of conventional loan will remove FHA MIP. However, based on the property's loan –to-value ratio. The insurance must to be in force for at least 5 years. On loans closed June 3, and thereafter, there is no way to stop paying FHA insurance premiums. The value of your home equity does not affect your FHA MIP, and having 20% in home equity will not allow you to cancel it. As a result, homeowners with FHA.

Mortgages with down payments of less than 20% will require PMI until you build up a loan-to-value ratio of at least 80%. You can also avoid paying PMI by using. FHA mortgage insurance can't be canceled if you make a down payment of less than 10%; you get rid of FHA mortgage insurance payments by. Refinance your mortgage. If you have an FHA loan and want to get rid of MIP (while also having enough equity in your home to avoid PMI), you could lower. A. Private mortgage insurance, or PMI, is an insurance product that protects lenders against financial losses when a homeowner stops paying on a loan. You'll need to apply all over again and provide your lender with pay check stubs, bank statements and other needed documentation. In this method, as long as the. The only way to avoid FHA MIP and UFMIP is to choose a different loan program. It's possible to stop paying FHA mortgage insurance premiums after 11 years, but. When your loan balance reaches 78% of the original value, PMI will be removed automatically — but to avoid paying more than necessary, simply contact your. The only way to eliminate the mortgage insurance payment on an FHA mortgage is to pay it off. If you are reluctant to deplete your financial. 5 ways to save money and avoid paying PMI · 1. Shop around for a loan that doesn't require PMI · 2. Check out state and local homebuyer assistance programs · 3. FHA mortgage insurance can't be canceled if you make a down payment of less than 10%; you get rid of FHA mortgage insurance payments by. There's no way to completely avoid paying MIP when you take out an FHA loan. However, there are a few ways that you can lower what you pay or stop paying a few. Unfortunately, if you received your mortgage proceeds between July 1, , and December 31, , then there's no way to cancel your MIP. You have to pay it. Borrowers who put less than 10% down are required to pay FHA MIP for the life of the loan, with no option to cancel. (The exception to these rules is FHA loans. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your monthly payment. If you're current on your mortgage. You cannot partially finance the UFMIP, which is a standard closing cost for FHA mortgages. The UFMIP is a one-time charge, the FHA mortgage insurance premium. MIP, on the other hand, is for FHA loans and has different rules for MIP removal. Insurance stays on for the life of the loan unless you make a 10% down payment. Other mortgage loans may require borrowers to come up with a larger down payment to take advantage of the option to stop paying mortgage insurance after Can I cancel my mortgage insurance at some point? Mortgage insurance is maintained at the option of the current owner of the mortgage. In many cases, the lender. FHA and VA loan mortgage insurance is paid to the FHA and VA and cannot be cancelled by paying down your mortgage principal faster. FHA mortgage insurance. The result — You get rid of your old PMI and avoid paying any new PMI premium. Luckily, FHA mortgage insurance is getting more affordable because.

Exogen Price

Exogen bone stimulation device. Insurance covered $1, of the $2, cost. Twice a day, the probe sits on the fracture site and a pulsating wave. Sale Price $ $ $ Original Price $ (25% off). FREE shipping. Add to Favorites. EXOGEN Bone Healing Carrying Case NO DEVICE parts Only Manual Charger Unit. $ Free shipping. Currently, Exogen, Inc. is the only manufacturer of an ultrasound osteogenic bone stimulator. They initially received Food and Drug Administration (FDA). Exogen® by LILA®, The World's Most Advanced Wearable Resistance. Modular, fully customisable micro-load system for high-performance training. Price, low to high; Price, high to low; Date, old to new; Date, new to old. Sort. 2; 3 Exogen. Exogen throat spray (20 ml). Regular price: €14, Add to. Weighted Strap Rental, if required, to be used with Exogen® + Ultrasound Machine. (Price includes £47 refundable deposit). £ Comment: Exogen ultrasound device is a cost effecient adjunct to conservative therapy. I would like to use this device on all of my Medicare patients with. Bottom line is that I forced to purchased a new Exogen system for $ to continued need therapy and was out the nearly $ I spent on initial purchase. Exogen bone stimulation device. Insurance covered $1, of the $2, cost. Twice a day, the probe sits on the fracture site and a pulsating wave. Sale Price $ $ $ Original Price $ (25% off). FREE shipping. Add to Favorites. EXOGEN Bone Healing Carrying Case NO DEVICE parts Only Manual Charger Unit. $ Free shipping. Currently, Exogen, Inc. is the only manufacturer of an ultrasound osteogenic bone stimulator. They initially received Food and Drug Administration (FDA). Exogen® by LILA®, The World's Most Advanced Wearable Resistance. Modular, fully customisable micro-load system for high-performance training. Price, low to high; Price, high to low; Date, old to new; Date, new to old. Sort. 2; 3 Exogen. Exogen throat spray (20 ml). Regular price: €14, Add to. Weighted Strap Rental, if required, to be used with Exogen® + Ultrasound Machine. (Price includes £47 refundable deposit). £ Comment: Exogen ultrasound device is a cost effecient adjunct to conservative therapy. I would like to use this device on all of my Medicare patients with. Bottom line is that I forced to purchased a new Exogen system for $ to continued need therapy and was out the nearly $ I spent on initial purchase.

The EXOGEN Bone Healing System uses safe, painless, low-intensity ultrasound waves to amplify your body's natural bone repair processes. Order now! Device Details According to our pricing database the average cost for a SMITH NEPHEW EXOGEN is $1,, which is based on the asking price found via 7. Sit Back, Relax and Let the Bone Healing Begin EXOGEN makes it easy to do more than simply wait to heal. Just 20 minutes a day of safe, painless treatment. Since my original device cost me almost $, I wasn't happy about the thought of shelling out another $ just because Exogen refused to service my. EXOGEN has the shortest daily treatment time compared to other bone stimulators at just 20 minutes a day and is the #1 prescribed bone healing system. Shop By Price · Weighted Applicator Strap for the Exogen Ultrasound Bone Stimulator by Bioventus - Free Priority Shipping · Ultrasound Gel for the Exogen. The EXOGEN ultrasound bone healing system to treat long bone fractures with non-union is associated with an estimated cost saving of £ per patient. EXOGEN is an ultrasound bone stimulator that has been prescribed by over 10K physicians annually, helping more than a million patients worldwide for over Exogen - NEWEST MODEL - Unused. Tested and working! This is the same model as is currently being shipped by the view more. July Asking Price: $1, D Exogen MPE Replacement Battery Volt Mah Lithium Exogen Bioventus Bone Healing System ELECTROCHEM GREAT BATCH Battery Discount. BIOVENTUS Exogen. Avg Price: Price range: - Filter. Price for Exogen. The minimum price for Exogen is $ and the maximum price. The EXOGEN Bone Healing System uses safe, painless, low-intensity pulsed ultrasound (LIPUS) to amplify natural bone healing three ways. When treating fractures, EXOGEN may be a cost-effective alternative to more invasive options. Heals Fractures That Aren't Healing on Their Own. Surgery. EXOGEN Rewards is a reimbursement program that encourages you to comply with your treatment regimen and achieve successful bone healing. Exogen Ultrasound System Bone Healing Full Kit Bioventus Fractures PARTS UNIT. price to MRP for the products and/or services set forth above, Buyer has. Prices for these devices vary depending on the type of device, but typically range from $1, to $3, Some insurance companies may cover the cost of a bone. Evidence shows that it's never too early or too late to use EXOGEN to help heal bones.3 Talk to your doctor about EXOGEN today. How Much Does it Cost? If you. confirmed that the correct price for the EXOGEN + is £ + VAT. The sponsor's submission indicated a health state cost of £ for patients who are. Find new and preloved exogen items at up to 70% off retail prices. Poshmark makes shopping fun, affordable & easy! The Exogen® company can be approached for a new memory card with available treatments but the cost will be in excess of our rental charge rates. EXOGEN.

Binance Sell Fees

4. Does Binance charge fees for trading? Binance charges a % fee for trading on the platform, therefore your pricing will be determined by the size of your. Binance withdrawal fees for crypto Binance always charges a withdrawal fee to cover transaction costs. However, keep in mind that the withdrawal fee varies. Binance charges a % trading fee when someone buys or sells coins on their platform. However, this fee can be reduced to as low as % if. Binance trading fees can vary based on factors such as trading volume and membership status. By understanding the fee structure and potential discounts. Binance charged a withdrawal fee of just LTC ($), significantly lower than Bybit's LTC ($) fee. Binance quickly processed the withdrawal. Easy Buy/Sell Convert · Support · Sign in Register. Scan to Download App IOS *Your Tier level and corresponding maker/taker fees are updated at AM. Binance · Main platform features: Low fees, comprehensive charting options, and hundreds of cryptocurrencies · Fees: % spot-trading fees, % for debit card. The fees for options trading are typically a flat rate per contract. Currently, Binance charges a flat fee of % of the notional value of the contract, which. Binance charges a % fee for trading on the platform as well as a % fee for Instant Buy/Sell, so your actual fee amount will depend on the amount of the. 4. Does Binance charge fees for trading? Binance charges a % fee for trading on the platform, therefore your pricing will be determined by the size of your. Binance withdrawal fees for crypto Binance always charges a withdrawal fee to cover transaction costs. However, keep in mind that the withdrawal fee varies. Binance charges a % trading fee when someone buys or sells coins on their platform. However, this fee can be reduced to as low as % if. Binance trading fees can vary based on factors such as trading volume and membership status. By understanding the fee structure and potential discounts. Binance charged a withdrawal fee of just LTC ($), significantly lower than Bybit's LTC ($) fee. Binance quickly processed the withdrawal. Easy Buy/Sell Convert · Support · Sign in Register. Scan to Download App IOS *Your Tier level and corresponding maker/taker fees are updated at AM. Binance · Main platform features: Low fees, comprehensive charting options, and hundreds of cryptocurrencies · Fees: % spot-trading fees, % for debit card. The fees for options trading are typically a flat rate per contract. Currently, Binance charges a flat fee of % of the notional value of the contract, which. Binance charges a % fee for trading on the platform as well as a % fee for Instant Buy/Sell, so your actual fee amount will depend on the amount of the.

The maker fees are trading commissions applied by the exchange to pending orders, such as a sell stop order or a buy limit order. The taker fees instead are. It is the giant. The titan. The most powerful player in the crypto world. It dwarves all other exchanges. It has million registered users. By registering an account on Binance using a referral link, you can receive fee discounts ranging from 5% to 20% on the Spot market and 10% on Futures. Fixed Trading Fees: Paxful platform charges selling fees of % for bank transfers, 1% for crypto and credit/debit cards, and 3% fees on gift cards. Binance says it charges % according to traded volume. Does both buy and sell apply in volume traded? Let's say I bought $ worth of bit. Summary: What's the difference between Binance and cn14.site? ; Available in the USA, No, Yes ; Fees, - % fees for trades under $1 million, - Binance excels in higher trading volume, an extensive range of over cryptocurrencies, and low fees ranging from % to %, positioning it as a favorite. A Binance fee is charged to cover the outflow of each virtual currency from the account. The amount is systematically adjusted based on certain factors, such as. The Binance trading fees are among the lowest in the market. Currently, regular users pay the maker/taker fees of % / % for spot trading. Trading. Withdrawal Fees. % (min. $), BTC ; Trading Fees. %, % ; Payment Methods ; MasterCard. Trading & Fees · Order Types · Buy, Sell, & Convert Crypto · Trading · Trading Fees · Recurring Buy · Trade Troubleshooting · OTC Portal · Market Maker Program. cn14.site charges a flat % fee for spot trading, which is notably lower than a lot of other online U.S. exchanges. Specifically, Coinbase charges % for. The maker fees are trading commissions applied by the exchange to pending orders, such as a sell stop order or a buy limit order. The taker fees instead are. In terms of trading fees, Binance charges a % fee for trading on the platform, including a % fee for an instant Buy/Sell. Broadly, your actual trading. Securely buy, sell, and hold cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Notcoin (NOT) and Pepe (PEPE) with low trading fees. Well, by default Binance charges 1% as trading fees, and by following the tricks mentioned in this article and embedded video, you will be able to save a. Binance deposit & withdrawal fees. Binance exchange has no deposit fee. Moreover, Binance has recently added new option: using credit card via Simplex. Even lower trading fees: Binance's trade fees, which range from % to % are some of the lowest in the industry. Binance Academy: New traders and. Here's the full breakdown of all fees charged by Binance US. This material is not intended as a recommendation, offer or solicitation for the purchase or sale. Securely buy, sell, and hold cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Notcoin (NOT) and PEPE (PEPE) with low trading fees.

Amex Cash Magnet Review

This card earns a flat rate of % cash back on purchases, making it easy to know exactly how much cash back you stand to earn whenever you use it. American Express Cash Magnet® Card Review. By Brian Martucci. The American The Amex EveryDay® Preferred Credit Card from American Express is a cash. The 2% back feature is extremely enticing, and the additional perks, including Amex offers and experiences, further enhance the attractiveness. AmEx Platinum Card for Schwab Review ( Update: 80k Offer) · AmEx Schwab Investor Credit Card Review ( Update: $ Offer) · AmEx Cash Magnet Credit. Wordplay aside, this no-annual-fee Amex credit card offers cardholders significant value with useful cash-back categories. You'll earn 3% cash back at U.S. Click “next” to review and accept terms and conditions. Confirm and The information related to the American Express Cash Magnet® Card and The Amex. The American Express Cash Magnet® Card offers earn unlimited % cash back on all purchases, making it a good choice for people who don't spend a lot in any. Additional Cash Magnet® Card Member Benefits. Travel with added peace of mind when you take Please review. © American Express. All rights reserved. The American Express Cash Magnet® Card offers a 0% APR on purchases for the first 15 months, then % to % after that. This is like an interest-free. This card earns a flat rate of % cash back on purchases, making it easy to know exactly how much cash back you stand to earn whenever you use it. American Express Cash Magnet® Card Review. By Brian Martucci. The American The Amex EveryDay® Preferred Credit Card from American Express is a cash. The 2% back feature is extremely enticing, and the additional perks, including Amex offers and experiences, further enhance the attractiveness. AmEx Platinum Card for Schwab Review ( Update: 80k Offer) · AmEx Schwab Investor Credit Card Review ( Update: $ Offer) · AmEx Cash Magnet Credit. Wordplay aside, this no-annual-fee Amex credit card offers cardholders significant value with useful cash-back categories. You'll earn 3% cash back at U.S. Click “next” to review and accept terms and conditions. Confirm and The information related to the American Express Cash Magnet® Card and The Amex. The American Express Cash Magnet® Card offers earn unlimited % cash back on all purchases, making it a good choice for people who don't spend a lot in any. Additional Cash Magnet® Card Member Benefits. Travel with added peace of mind when you take Please review. © American Express. All rights reserved. The American Express Cash Magnet® Card offers a 0% APR on purchases for the first 15 months, then % to % after that. This is like an interest-free.

Learn More About ShopRunner for Your Cash Magnet & Other American Express Card Benefits You can review these Terms and Conditions at any time by visiting. You'll pay no annual fee for this card and earn 2% cash rewards on every purchase up to the first $50, you spend per year without having to track spending. This card has a $0 intro annual fee for the first year (then $95) (see rates and fees), but it can be offset by the cash back you earn and discounts you can get. Pros & Cons ; Welcome Bonus. Average Cashback Ratio ; Flat Cash Back Rate. Foreign Transaction Fee ; 0% Intro APR. Limited Redemption Options ; American Express. The American Express Cash Magnet card is one of the easiest cards to wrap your head around, with its flat % cash back earning rate on everything purchased. Cash Magnet® Card from American Express. Cash Magnet® Card. Delta SkyMiles Please review. © American Express. All rights reserved. "Got American Express Cash Magnet card that promises % cash back on purchases. Used the card and they did not provide cash back on purchases after my bill. Blue Cash Everyday Card · 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) · Created with Sketch. ; Cash Magnet Card · Unlimited % cash back. American Express Cash Magnet Credit Card Review What is the capital of France? Paris % London %. Signup bonuses are an easy way to make a few. American Express Cash Magnet® Card · Annual Fee. The AMEX Cash Magnet Card does not have an annual fee. · Authorized User Fee. There is no fee to add authorized. Bottom line. The American Express Cash Magnet® Card is great for families and individuals who like the idea of a simple, no annual fee credit card that lets you. The American Express Cash Magnet™ Card is a cash-back credit card designed for individuals who prefer straightforward rewards. It offers unlimited cash-back. The American Express Cash Magnet® Card is a straightforward cash back credit card with no annual fee and a flat, unlimited cash back earning rate on all. Click “next” to review and accept terms and conditions. Confirm and The information related to the American Express Cash Magnet® Card and The Amex. AMEX Cash Magnet Card Review A Penny Pinchers Guide to Personal Finance · · Amex Blue Cash Everyday Card Review A Penny. This cash back credit card offers percent cash back for every dollar you spend – with no categories to track and no limit to how much cash back you can. You'll pay no annual fee for this card and earn 2% cash rewards on every purchase up to the first $50, you spend per year without having to track spending. Cash Magnet® Card from American Express. Cash Magnet® Card. Delta SkyMiles Please review. © American Express. All rights reserved. Feedback. The American Express Cash Magnet Card is a simple, middle-of-the-road, cashback credit card — but still offers benefits true to Amex's signature touch. Earn Cash Back on purchases with the American Express Cash Magnet® Card - a simply Please review. © American Express. All rights reserved. .

How To Pay Off Credit Card Debt In One Year

1. Cut Up Your Credit Cards · 2. Pay With Cash (or Debit) · 3. Gather Your Support Team · 4. Don't Consolidate Your Debt · 5. Reduce Your Expenses · 6. Increase Your. Debt repayment methods · Organize your debts according to balance — from smallest to largest. · Make minimum payments on all your debts. · When the first debt is. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Useful tips · If you have multiple credit cards, focus on paying off the card with the highest interest-rate first. · Take advantage of special offers like 0%. The 6-step method that helped this year-old pay off $30, of credit card debt in 1 year · Step 1: Survey the land · Step 2: Limit and leverage · Step 3. By paying your debt shortly after it's charged, you can help prevent your credit utilization rate from rising above the preferred 30% mark and improve your. What to Do ; Strategy 1: Pay Off the Smallest Balance First · List your credit cards from lowest balance to highest. Pay only the minimum payment due on the cards. In the snowball method, you start by paying extra on the credit card with the smallest balance until it's paid off. Then move on to the card with the next. How I paid off $20, of credit card debt in one year · I developed a debt payoff plan. · I cut my spending. · I saved money on rent. · I learned about. 1. Cut Up Your Credit Cards · 2. Pay With Cash (or Debit) · 3. Gather Your Support Team · 4. Don't Consolidate Your Debt · 5. Reduce Your Expenses · 6. Increase Your. Debt repayment methods · Organize your debts according to balance — from smallest to largest. · Make minimum payments on all your debts. · When the first debt is. 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at a time. · 4. Consolidate credit card debt. · 5. Useful tips · If you have multiple credit cards, focus on paying off the card with the highest interest-rate first. · Take advantage of special offers like 0%. The 6-step method that helped this year-old pay off $30, of credit card debt in 1 year · Step 1: Survey the land · Step 2: Limit and leverage · Step 3. By paying your debt shortly after it's charged, you can help prevent your credit utilization rate from rising above the preferred 30% mark and improve your. What to Do ; Strategy 1: Pay Off the Smallest Balance First · List your credit cards from lowest balance to highest. Pay only the minimum payment due on the cards. In the snowball method, you start by paying extra on the credit card with the smallest balance until it's paid off. Then move on to the card with the next. How I paid off $20, of credit card debt in one year · I developed a debt payoff plan. · I cut my spending. · I saved money on rent. · I learned about.

Part of your plan could be to pay off the card with the highest interest rate first. This can be a big money-saver over time, since you'll be knocking out the. The Easiest Way to Pay Off Credit Card Debt · Create a credit card repayment plan · Stop adding to your debt · Follow the debt snowball method · Follow the debt. 1. Use any extra money you can come up with to pay off your credit card with the smallest balance first (ignore the interest rates and just focus on the. Make the minimum payment on every card, every month, but throw whatever extra money you have at the one with the lowest balance. When that one is paid off, take. Make a list of your essential expenses (needs, not wants). This includes housing, utilities, food, transportation and the minimum monthly payments on all your. Target one debt at a time · Focus on high-interest debt · Try the snowball method ; Consolidate debt · Transfer balances · Tap into your home equity ; Review your. When a card is paid off, apply additional payment to the card with the next smallest balance. Strategy 2: Pay Off the Highest. Interest Rate First. This is the. Avalanche method: focus on highest interest · Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card. A good debt consolidation loan will pay off your credit cards all at once, rearranging your finances to pay off the loan at a lower interest rate over a longer. Focus on the Most Expensive Balances First. If you owe multiple balances, allocate the lion's share of your monthly debt payment to the balance with the highest. How to pay off credit card debt: 7 tricks · 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. How To Pay off Credit Card Debt · 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards. Avalanche method: focus on highest interest · Make the minimum payment on all your cards to avoid late fees and finance charges. · Pay extra on your credit card. If you need help paying off your credit cards, the first step is to completely stop using them. It may be easier said than done, but it works. Credit cards are. Tips to pay off $50, of debt in a year · 1. Create a budget and track your income and spending · 2. Be mindful of debt fatigue · 3. Prioritize paying high-. Strategies for paying off credit card debt · Debt avalanche method: This method, also known as the highest interest rate method, involves identifying debts with. Start with the 50/30/20 rule · Create a list of your debts. Record all your debts, including credit cards, personal loans, student loans, and auto loans. · Pay. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. This repayment strategy, sometimes called the avalanche method, prioritizes your debts from the highest interest rate to the lowest. First, you'll pay off your.

Which Loan Is Lowest Interest Rate

Find and compare the best personal loans to fit your profile. Compare lenders, interest rates and keep track of your credit with free online tools. loan with low credit, your loan may come with higher interest rates. If I check my personal loan rate, will it impact my credit? It will not. When you check. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Compare current personal loan interest rates from a comprehensive list of lenders. On average, VA loan rates are typically lower than both FHA and conventional mortgage rates. VA loan rates are generally lower due to the VA backing a portion. What is considered a high or low interest rate depends on the specific type of loan. For example, credit cards often carry high interest rates, commonly in the. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Why apply for a home equity line of credit? · Own and have equity in your home · Want ongoing access to funds · Want payments as-low-as interest only on what you. Best Low-Interest Personal Loans of September ; SoFi · · % to % ; LightStream · · % to % ; PenFed Credit Union. · % to %. Find and compare the best personal loans to fit your profile. Compare lenders, interest rates and keep track of your credit with free online tools. loan with low credit, your loan may come with higher interest rates. If I check my personal loan rate, will it impact my credit? It will not. When you check. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Compare current personal loan interest rates from a comprehensive list of lenders. On average, VA loan rates are typically lower than both FHA and conventional mortgage rates. VA loan rates are generally lower due to the VA backing a portion. What is considered a high or low interest rate depends on the specific type of loan. For example, credit cards often carry high interest rates, commonly in the. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Why apply for a home equity line of credit? · Own and have equity in your home · Want ongoing access to funds · Want payments as-low-as interest only on what you. Best Low-Interest Personal Loans of September ; SoFi · · % to % ; LightStream · · % to % ; PenFed Credit Union. · % to %.

Annual Percentage Rate (APR). % - %* APR with AutoPay · Loan purpose. Debt consolidation, home improvement, auto financing, medical expenses, and others. What are the differences between federal and private student loans? · Interest rates · The interest rate is fixed and is often lower than private loans—and much. Assumptions · *APR based on a $K sales price, 10% down payment, financing the VA funding fee under the CalVet/VA loan program, and one-year premium for. Pay a one-time fee for a lower interest rate. You can even get same-day funding, depending on when your loan is approved. The lender's interest rates are. Our top picks for best low-interest personal loans are Discover (% to % APR), LightStream (% to % APR) and SoFi (% to % APR). The Illinois Department of Commerce & Economic Opportunity offers low-interest loan programs to help your business. The major bank with the lowest interest rate for a personal loan is Barclays, which advertises APRs of % - %. Other notable banks with low personal. The lenders partnered with Loans Canada typically offer interest rates as low as %–% on amounts that range $ to $50,, with funding for some. Lowest interest rates charges by banks on their personal loans: ; Bank, Minimum interest rate on personal loan (%) ; ICICI Bank, ; HDFC Bank, ; State. ICICI Bank offers one of the lowest interest rate Personal Loans with a competitive interest rate at %* p.a.. APPLY PERSONAL LOAN. Compare the best low-interest personal loans ; Upstart. % to %. $1, to $50, ; PenFed. % to %. $ to $50, ; Prosper. % to %. lower interest rate and higher credit limit. Where can I learn more about bank loans for specific purposes? While this basic information holds true for most. + credit score – You'll qualify for the lowest rates, likely under 6%. credit score – You'll get a good rate, usually around %. credit. Compare personal loan rates from top lenders for September ; LightStream · · Loan term. 2 - 7 years ; Upstart · · Loan term. 3, 5 years. The lowest rate available assumes excellent credit history. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of. Your credit score has a direct influence on the personal loan interest rate you qualify for. Good credit scores of or higher usually mean you'll get lower. Compare mortgage interest rates to find the best mortgage rates for your home loan. See daily average mortgage rate trends and the rates forecast for Here's a look at things you can do to score a lower interest rate on a personal loan and save money while you pay it off. The Low Interest Rate Program provides qualified low and moderate income first time home buyers with low down payment mortgage financing on one to four family. When two parties engage in a loan transaction, minimum-interest rules can mandate that an interest rate that's not too low be charged, even in family deals.

Spot Price Of Sterling Silver Troy Ounce Today

Today, Change. Silver Price Per Ounce, $, Silver Price Per Gram The spot silver price is quoting the price for 1 troy ounce of fine silver. Silver costs $ per ounce as of December 6, , with a standard closing price of $ Real (inflation-adjusted) silver costs per ounce have fluctuated. Live Silver Spot Prices ; Silver Prices Per Ounce, $ + ; Silver Prices Per Gram, $ + ; Silver Prices Per Kilo, $ + Sterling Silver Price Per Oz $ Find the current Sterling Silver Price Per Oz based on live silver market rates. 24/7 / days a year. When we speak of. We mint bars in several large and fractional weights including 1 oz, gram, 5 troy ounce and even troy ounces. The current price of silver is roughly. Our sterling silver calculator provides the current scrap or melt value of sterling silver flatware or jewelry. Silver @ $ /cn14.site Measured in pounds. Total $11, Per t. See live and historical Silver Spot Price Charts here. Find what the Silver Price Today is and what historic Silver Spot Prices have been in this full fiat. Buffalo 1 oz Silver Round Pure). As Low As:$ Qty: Add To Cart The spot price of silver reflects the current value for one troy ounce of. Today, Change. Silver Price Per Ounce, $, Silver Price Per Gram The spot silver price is quoting the price for 1 troy ounce of fine silver. Silver costs $ per ounce as of December 6, , with a standard closing price of $ Real (inflation-adjusted) silver costs per ounce have fluctuated. Live Silver Spot Prices ; Silver Prices Per Ounce, $ + ; Silver Prices Per Gram, $ + ; Silver Prices Per Kilo, $ + Sterling Silver Price Per Oz $ Find the current Sterling Silver Price Per Oz based on live silver market rates. 24/7 / days a year. When we speak of. We mint bars in several large and fractional weights including 1 oz, gram, 5 troy ounce and even troy ounces. The current price of silver is roughly. Our sterling silver calculator provides the current scrap or melt value of sterling silver flatware or jewelry. Silver @ $ /cn14.site Measured in pounds. Total $11, Per t. See live and historical Silver Spot Price Charts here. Find what the Silver Price Today is and what historic Silver Spot Prices have been in this full fiat. Buffalo 1 oz Silver Round Pure). As Low As:$ Qty: Add To Cart The spot price of silver reflects the current value for one troy ounce of.

Silver prices eventually came back down, however, bottoming out in at less than $14 per ounce. The price of silver since that time has been oscillating. Silver Price is at a current level of , up from last month and up from one year ago. This is a change of % from last month and %. Current Silver Gram Bar Values ; Description, Silver Value (USD) ; 1 gram silver bar, $ ; gram silver bar, $ Silver prices today ; US Dollar (USD), , $, $, $ ; British Pound (GBP), , £, £, £ 1 Troy Ounce ≈ 1, Ounce, Silver Price Per 1 Ounce, USD ; 1 Troy Ounce ≈ 31,10 Gram, Silver Price Per 1 Gram, USD. The spot price of silver can change on a moment's notice, and savvy investors will wait for the right moment to buy silver bullion at the cheapest price. The current live silver spot price is Silver Standard/Purity, Today's Silver Spot Price Per Troy Ounce. Fine Silver, $ Britannia Silver, $ Sterling Silver Scrap Calculator. Current Silver Price (USD/oz) (may be adjusted for future calculations): $ Approximate Purity. The total silver value is calculated based on the currency amount shown in the Silver Price text box. The current silver spot price is updated frequently during. Live and historic Silver price charts available. View Silver prices in Pound Sterling (GBP) Current Live Market Prices per gram: Gold: Bid, Mid, Ask. Currently, the spot price for 1 Ounce (1 oz) of silver is £ Silver price charts by Weight/Time Period. Silver price in USD per troy ounce today. Annual Silver Prices since ; , $, $ ; , $, $ ; , $, $ ; , $, $ The current price of Sterling Silver (anything) is $25 per Ounce (oz), or (% of pure silver x silver price x troy ounce modifier). % of pure silver. Silver Value Calculator · Weight of your silver item(s). · Grade or purity of your item. · Current market price in troy ounces of silver. We recommend going to CNN. Silver Price per Ounce USD. Ag. Current Price. $ Week Change. %. Since we know that the current silver price per gram is $, we can determine that the current spot price of one pound of sterling silver is $ What. Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. To the right are live silver spot prices per troy ounce, gram, and kilogram. Today, silver bullion coins and collectible coins are available to those. The default representation of the silver price is usually in Troy Ounces as above, but you can use the chart oprions above to show the silver prices in grams. Current Silver Price per Troy Ounce: USD $, GBP £, CAD $, EUR Mass of Pure Silver (Grams), g. Mass of Pure Silver (Oz), Oz.

Tax Rate On Roth Ira Withdrawal

Withdrawals of your traditional IRA contributions before age 59½ will result in regular income tax on the taxable amount of your withdrawal plus a 10% federal. Roth withdrawals, including any investment earnings, are not taxed if you meet the minimum qualifications. These include a five-year holding period from the. Penalties: If you wait until you're at least age 59 1/2, you won't pay the 10% early withdrawal penalty on your IRA withdrawals. · Taxes: If you claimed a. Because you contribute to a Roth IRA with after-tax dollars, you can withdraw your contributed funds at any time. However, you will be subject to taxes on gains. "A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Guidelines for withdrawals. Withdrawals before age 59½. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. However, if the distribution is a not a Qualified Distribution you will be subject to income taxes on all the earnings along with a 10% early withdrawal penalty. Our Traditional IRA saver must pay taxes when they take distributions, but if they are taxed at the same 25% rate, they end up with the same $30, The. Withdrawals of your traditional IRA contributions before age 59½ will result in regular income tax on the taxable amount of your withdrawal plus a 10% federal. Roth withdrawals, including any investment earnings, are not taxed if you meet the minimum qualifications. These include a five-year holding period from the. Penalties: If you wait until you're at least age 59 1/2, you won't pay the 10% early withdrawal penalty on your IRA withdrawals. · Taxes: If you claimed a. Because you contribute to a Roth IRA with after-tax dollars, you can withdraw your contributed funds at any time. However, you will be subject to taxes on gains. "A Roth IRA or Roth (k) can help you save on taxes in retirement. Not only are withdrawals potentially tax-free,2 they won't impact the taxation of your. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. Guidelines for withdrawals. Withdrawals before age 59½. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. However, if the distribution is a not a Qualified Distribution you will be subject to income taxes on all the earnings along with a 10% early withdrawal penalty. Our Traditional IRA saver must pay taxes when they take distributions, but if they are taxed at the same 25% rate, they end up with the same $30, The.

Please remember that the taxable portion of your distribution is taxed as ordinary income for the year in which you withdraw it. Withdrawals using these options. Therefore, if the taxpayer takes a $10, distribution for a down payment on a first home and the taxpayer is in the 25 percent tax bracket, the $10, Payments from the Roth IRA that are not qualified distributions will be taxed to reduced rate of withholding under an income tax treaty. For more. Contributions to a Roth IRA are not tax-deductible, so there is no tax deduction, regardless of income. Nonqualified distributions may be included in gross. Our Traditional IRA saver must pay taxes when they take distributions, but if they are taxed at the same 25% rate, they end up with the same $30, Subsequent distributions from your Roth IRA or Roth eligible employer account may be taxed and subject to the 10% early withdrawal penalty (see page 3) if that. According to the IRS, to discourage the use of IRA distributions for purposes other than retirement, you'll be assessed a 10% additional tax on early. Roth IRAs allow you to pay taxes on money going into your account and then all future withdrawals are tax-free. Roth IRA contributions aren't taxed because the. In this example, Paul could take $25, from his IRA, bringing the couple's taxable income for the year to $, Therefore, the Kings would remain in the. The entire amount is usually taxable. However, you will not pay penalties if you need funds for one of the following: Unreimbursed medical expenses (must be. Roth IRA contributions aren't tax-deductible. Unlike contributions to other tax-advantaged retirement accounts, you won't get an upfront tax benefit from those. Income on assets held in an IRA is not taxable. • Distributions can be considered income for. PA personal income tax purposes to the extent distributions exceed. Your withdrawals from a Roth IRA are tax free as long as you are 59 ½ or older and your account is at least five years old. Withdrawals from traditional. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. Before age 59½, the IRS considers your. The U.S. government charges a 10% penalty on early withdrawals from a Traditional IRA, and a state tax penalty may also apply. You can learn more at IRS. Roth IRA withdrawals in retirement are typically tax-free. When you need to pay taxes on the Roth IRA investment earnings. Sponsored Gold IRAs. Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10% early withdrawal penalty. Tax Rates and Traditional vs. Roth IRAs. If tax. When you make withdrawals, any earnings are considered regular income and are taxed at your regular federal income tax rate. If you deducted the contributions. In most cases, IRA cash distributions are subject to a default 10% federal withholding rate. While your Roth IRA contributions are considered after-tax. When you make a withdrawal from a Roth IRA, the portion of the withdrawal that represents your contributions is not taxable, since the contributions were taxed.

How Is A House Appraisal Done

Before you buy a house, sell it, or refinance it, a home appraisal is an important part of the process. · A home appraisal, also known as a real estate appraisal. An appraisal report determines the home's value during the home loan process. We order the appraisal during the loan setup stage of the mortgage loan process. The party that owns the loan is generally responsible for paying for the appraisal services during the closing process · The appraisers arrives at the property. The appraiser communicates with the mortgage lender on the amount the property is worth, whereas the home inspector communicates with the buyer or seller of the. Then, the lender will select a state-licensed appraiser who will coordinate a time for a home visit with the seller. The first step is the appraisal inspection. An appraisal compares the value of the property to similar properties in the same neighborhood. These services are performed by independent appraisers and. A lender uses an appraisal not only to assess the value of the property, but also to determine such things as your interest rate, required down payment, and. Off-site, the appraiser may also evaluate the current real estate market in the neighborhood to help determine the value of the property. Usually, the lender or. This can be troublesome for your mortgage refinance because a low appraisal can mean a higher loan to value (LTV), which can affect your interest rate. Don't. Before you buy a house, sell it, or refinance it, a home appraisal is an important part of the process. · A home appraisal, also known as a real estate appraisal. An appraisal report determines the home's value during the home loan process. We order the appraisal during the loan setup stage of the mortgage loan process. The party that owns the loan is generally responsible for paying for the appraisal services during the closing process · The appraisers arrives at the property. The appraiser communicates with the mortgage lender on the amount the property is worth, whereas the home inspector communicates with the buyer or seller of the. Then, the lender will select a state-licensed appraiser who will coordinate a time for a home visit with the seller. The first step is the appraisal inspection. An appraisal compares the value of the property to similar properties in the same neighborhood. These services are performed by independent appraisers and. A lender uses an appraisal not only to assess the value of the property, but also to determine such things as your interest rate, required down payment, and. Off-site, the appraiser may also evaluate the current real estate market in the neighborhood to help determine the value of the property. Usually, the lender or. This can be troublesome for your mortgage refinance because a low appraisal can mean a higher loan to value (LTV), which can affect your interest rate. Don't.

Their professional assessment will provide an estimate of what the home is worth on the real estate market. 6 Reasons to Invest in a Home Appraisal. Verify. The direct comparison approach is based on the premise that the value of a specific property is set by the price an informed purchaser would pay for a. A home appraisal is different from a home inspection. A real estate appraiser looks for things that affect the overall value of the house. It will take the appraiser an average of seven to 10 days to look at the property, complete the research process, prepare the appraisal report and deliver it. Credible appraisals clearly identify the property appraised, the scope of work performed by the appraiser, the client and other intended users, and the intended. A lender uses an appraisal not only to assess the value of the property, but also to determine such things as your interest rate, required down payment, and. Also by law, you are entitled to receive a copy of the completed appraisal report from your lender. To facilitate the appraisal process, it's beneficial to have. Appraisals are conducted for single-family homes, condominiums, and multi-unit dwellings. An appraisal is not a home inspection. A licensed appraiser. An appraisal is an opinion of the market value of your home, and it's performed by a third-party professional with state-issued appraiser credentials. When we had our appraisal done, the report showed 6 comps they used An appraisal is an educated opinion of the actual value of a property. The lender puts the order into a “lottery” system of licensed appraisers, that assigns one at random. The appraiser is given the listing agent's contact. The appraisal process is the process of collecting, analyzing and reconciling data that relates to the property being appraised and in this case we are talking. A licensed home appraiser conducts a real estate appraisal by inspecting the home and researching the sale price of comparable homes. Appraisers use the cost. So What Exactly Is a Home Appraisal? · A street map showing the appraised property and comparable sales · An exterior building sketch · An explanation of how the. 3. Inform your home appraiser of any home improvements you have done on your home. Be sure to tell your appraiser about any improvements you've made in. As a matter of fact, the inspection of the property is the shortest step in the appraisal process. The appraiser measures the house from the outside to. How do I get ready for the appraiser? The first step in most appraisals is the home inspection. During this process, we will come to your home and measure it. These appraisals are typically conducted when a borrower is applying for a mortgage loan to buy a home. The lender will order an appraisal to ensure that the. Residential property appraisals are conducted by licensed residential or certified residential appraisers to help the lender ensure the purchase price is in. A lender uses an appraisal not only to assess the value of the property, but also to determine such things as your interest rate, required down payment, and.

1 2 3 4 5